Abstract

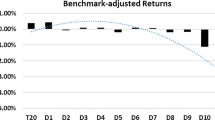

We examine how investment advisors guide the decision-making process of mutual fund investor clienteles by comparing the flow-performance sensitivity of no-load funds and the three main classes of load fund shares, conditional on the state of the market and on fund-specific non-linear and asymmetric return patterns. Our results indicate that the association between flows and returns is different across mutual fund share classes and conclusions regarding the simple association between fund flows and performance change when more complex return patterns are incorporated into the analysis.

Similar content being viewed by others

Notes

I There are other classes, such as those available only to institutional investors or through retirement plans, but the categories are not standardized for the industry and are therefore excluded from this study.

References

Chalmers, J., Kaul, A. and Phillips, B. (2013) The wisdom of crowds: Mutual fund investors’ aggregate asset allocation decisions. Journal of Banking & Finance 37 (9): 3318–3333.

Chevalier, J. and Ellison, G. (1997) Risk taking by mutual funds as a response to incentives. Journal of Political Economy 105 (6): 1167–1203.

Huang, J., Wei, K. and Yan, H. (2007) Participation costs and the sensitivity of fund flows to past performance. Journal of Finance 62 (3): 1272–1311.

ICI (Investment Company Institute) (2013) 2013 Investment Company Fact Book, 53rd Ed. Investment Company Institute, www.icifactbook.org.

Ippolito, R. (1992) Consumer reaction to measures of poor quality: Evidence from the mutual fund industry. Journal of Law and Economics 35 (1): 45–70.

Jank, S. (2012) Mutual fund flows, expected returns, and the real economy. Journal of Banking and Finance 36 (11): 3060–3070.

Nanda, V., Wang, Z.J. and Zheng, L. (2009) The ABCs of mutual funds: On the introduction of multiple share classes. Journal of Financial Intermediation 18 (3): 329–361.

O’Neal, E. (2004) Purchase and redemptions patterns of US equity mutual funds. Financial Management 33 (1): 63–90.

Sirri, E. and Tufano, P. (1998) Costly search and mutual fund flows. Journal of Finance 53 (5): 1589–1622.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Nenninger, S., Rakowski, D. Time-varying flow-performance sensitivity and investor sophistication. J Asset Manag 15, 333–345 (2014). https://doi.org/10.1057/jam.2014.32

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2014.32